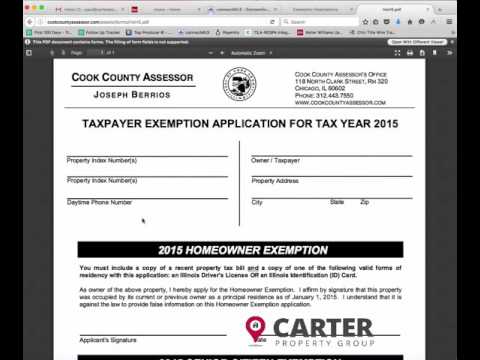

Hello from Carter Property Group. This is Paul, and today, this video is going to go through the steps of applying for the 2015 homeowners exemption. First, we'll go to cookcountyassessor.com and under exemptions, choose the drop-down option for exemption description. You'll see each of the exemptions that are available to Cook County homeowners. We're going to go over the homeowner exemption. There are two drop-down menus even further into the process. The first is an application, which is a downloadable PDF file, and the second is some additional information on how to receive the homeowners exemption. So, you want to make note of both of these. If you click the PDF file, it'll open up and ask for some basic information. It requires the property identification number or property index number, homeowner property address, city, state, and zip, daytime phone number. It requires you to assert that you've lived in the property for the past calendar year, from January 1st, 2015 to the present, and that you're living in the property. You're asserting that with your signature. Here you'll date it, and then there's another piece of information that needs to come along with it. So, you must include a copy of a recent property tax bill and a copy of one of the following valid forms of residency with this application. That would be an Illinois driver's license or an Illinois identification card. Obviously, it must have the same address on it. So, if you print this out through the print button at the top of the screen, you should be all set to have the form, fill it out, along with the copies of the tax bill and your Illinois driver's license. So, that's how you apply for the 2015 homeowner exemption. Thanks for tuning in. We'll...

Award-winning PDF software

Nys property tax exemptions Form: What You Should Know

If you are unsure if you qualify for tax benefits or if you are interested in requesting a benefit from the City, please go to the Tax Benefits Page, call 311 or visit. You can also contact the New York City Department of Finance and Administrative Services at for more information. Property tax exemptions — Tax.NY.gov You may qualify for free and reduced real estate property taxes if you: Owned your primary residence before October 8, 2005; and Own your primary residence on Oct. 8, 2025 or before. Free property taxes are subject to the following restrictions: This exemption applies to real property under the sole ownership of a person who holds a Certificate of Occupancy, which is issued after obtaining all property tax reduction preferences (which includes the exemption) Property tax exemptions — Tax.NY.gov Property tax exemptions — Tax.NY.gov Sep 26, 2025 — Property values reduced by 50% for single-family residences over 700,000 • 300 property tax rebate for Single-Family Residences over 800,000; • 75 property tax rebate for Multifamily Residences over 900,000; and • New York State Housing Tax Exemption up to 150,000 Property tax exemptions — Tax.NY.gov Sep 26, 2025 — Property taxes paid from 2025 to 2025 and taxes paid in that same period must be filed by Dec 31, 2025 for property taxes paid by Dec 31, 2018; and by Dec 31, 2025 for taxes paid by Dec 31, 2017. For taxes paid before 2019, tax filers should file their returns before Oct 20, 2018. Property tax exemptions — Tax.NY.gov Property tax exemptions — Tax.NY.gov Sep 26, 2025 — Property tax exemptions. For property tax exemptions, click here. Property tax exemptions — Tax.NY.gov Sep 26, 2025 — Exemption for non-profit and charity organizations, and for all religious organizations. The property tax exemption for charitable organizations is 300 to 500 of a property's assessed price. For non-profit organizations, the tax exemption is 10 to 150 of the property's assessed price. For religious organizations, the tax exemption is 5 to 150 of the property's assessed price, including amounts that are reduced with respect to the exemption for religious property. Sep 26, 2025 — Single family-residential property.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form RP 99-38, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form RP 99-38 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form RP 99-38 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form RP 99-38 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Nys property tax exemptions